Assessment & Taxation

Monday–Friday 8:30 a.m. to 4:00 p.m

Property Search Online

Our newly redesigned account web query is now called Property Search Online.

Important Deadlines

Property Tax Statements for 2023/24:

Were mailed on October 18, 2023 and are online

Were due on November 15, 2023

If paying in installments, the 2nd installment was due on February 15, 2024, and 3rd installment will be due on May 15, 2024

Payments must be postmarked on or before the due dates above to avoid loss of discount and interest charges. For address changes, click here.

Business Personal and Real Property Returns for 2024/25:

Were mailed on December 29, 2023.

Were due on March 15, 2024.

Exemptions (including Veterans), Non-Exclusive Farm Use and Designated Forestland Applications for 2024/25:

were due on April 1, 2024

Funding and Basis

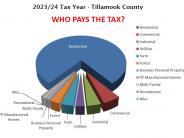

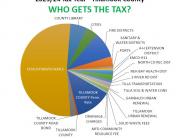

Oregon law requires the assessment of real and personal property to determine the amount of property taxes that property owners pay to the various taxing districts. (See Summary of Assessment). The department's funding is primarily provided through a grant and property taxes.

Services

- Location of property by owner, address, and account number or map number.

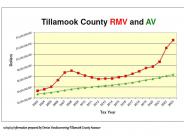

- Real Market Value and Assessed Value of each property in the county, both current and for prior years.

- Appraisal inventory for both land and structures, i.e. size of land, square footage of structures, components of the house, year built, condition of the property and structures as of date appraised, and other relevant information.

- Tax Statements can be found online.

- Property sales data on all recorded transactions.

- Reports on sales, assessment, and ownership information.

- Special assessment programs for farm, forest, historical, and open space properties.

- Exemptions and partial exemptions for veterans, religious, fraternal, benevolent, charitable and scientific institutions, senior service centers, and cemetery and burial grounds. For more information on these exemptions, please visit the Oregon Department of Revenue's website

- Other short term exemptions such as Commercial Facilities under Construction, Enterprise Zone, and Pollution Control Facilities.

- Tax deferral programs such as the Senior Citizen's Tax Deferral Program and the Disabled Citizen's Property Tax Deferral Program.

- Collect property tax for taxing districts.

- Forms for property value appeals from the Department of Revenue and Oregon Tax Court

Users of Our Services

- Title Companies, Fee Appraisers, and other departments and agencies use our information in preparing title searches, finding comparable sales, and determining ownership and location or the condition of a property as of a given date.

- Real estate sales offices inquire about our inventory data, assessed values, and taxes.

- Attorneys use our assessed value information to establish market value in domestic disputes.

- Banks sometimes use our assessed value information on home equity loans.

- The general public inquires about sales in a particular area in preparation for buying or selling property and may inquire on property owner's names, mailing addresses, assessed value, and tax information.